Protocol Fees

At SOFA, we are committed to creating a fair and transparent financial ecosystem where users can democratically purchase in a wide gamut of structured products with transparent and fair pricing from market makers. Furthermore, as a fully decentralized project, we want to ensure that any protocol gains are primarily shared with our underlying users, ensuring full incentive alignment rather than privileged payouts to special interest groups. As such, we have devised a series of fee structures with 'fair-launch' tokenomics to ensure proper value-accrual and support long-term platform longevity. There will be no VC joy-riding or exit-liquidity dumps within SOFA.

Protocol Fees

💰 SOFA will collect 15% of the user's option premium as a base trading fee. Furthermore, in the event of a 'winning' payout occurring for the user, a further 5% settlement fee will be charged against the total Gross Upside Payout.

Fee Calculations

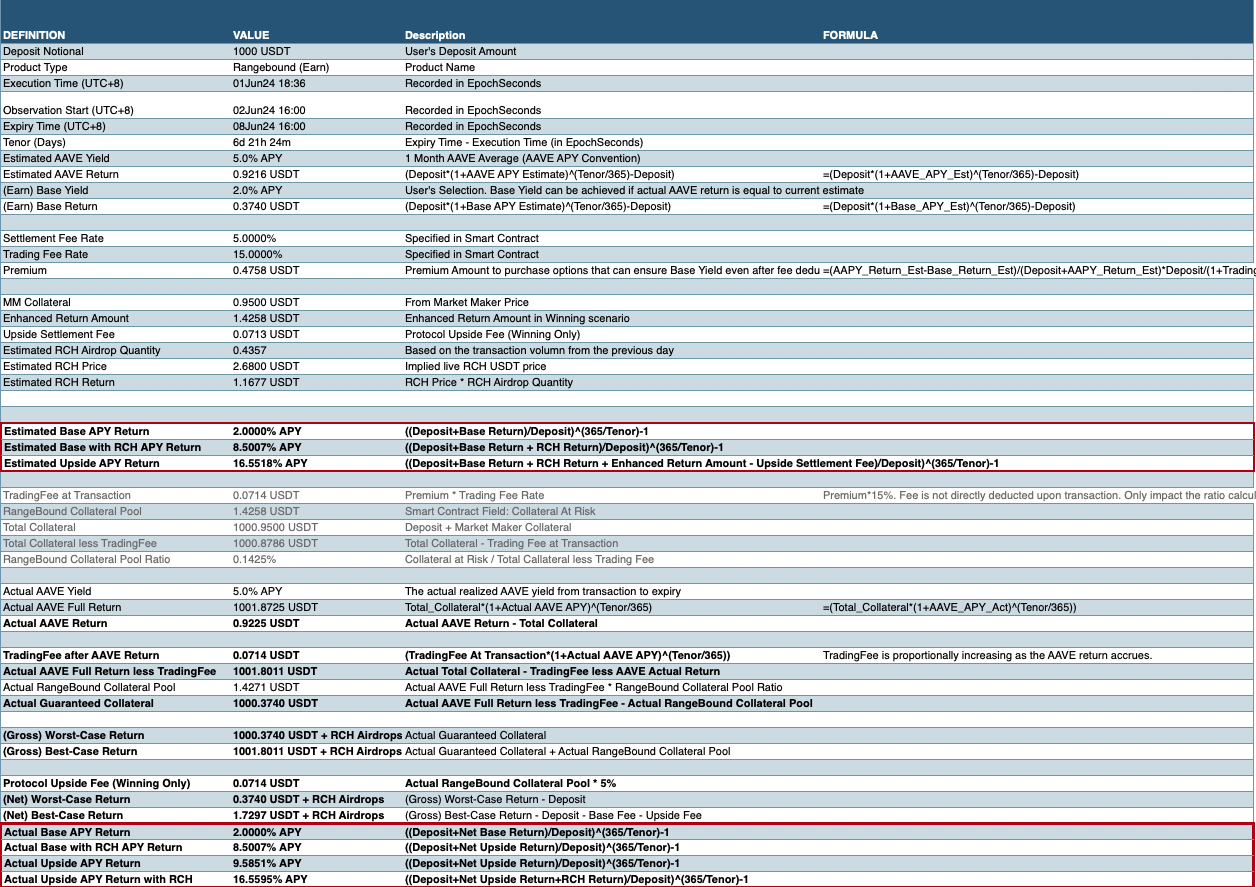

For full transparency, please see the following example of how fees and payoffs are calculated in our protocols.

Definitions:

MM's Collateral = Vault-Locked Collateral from Market Maker

Observation Window:

From the next 16:00 (UTC+8) to Expiry Day 16:00 (UTC+8)

User Payoffs at Expiry:

If Knocked-Out

No Knocked-Out

Numerical Example (Rangebound)

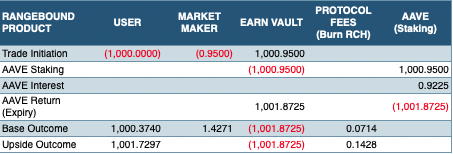

Distribution Waterfall (USDT)

Native Token ($RCH) Buyback

Aligning protocol success with Token performance

At SOFA, we believe that the most straight-forward way to align user and hodler incentives are through token buybacks, with $RCH being our native utility token. We will commit all protocol income to be exclusively used for $RCH buybacks, creating a virtuous loop of token price gains being driven off protocol usage.

With a fixed deflationary supply, methodical release schedule, and usage-driven airdops, the long-term value accretion for $RCH is largely a function of protocol revenue, which in itself is a direct measure of adoption success. Furthermore, with Token airdrops exclusively limited to protocol users and supporters, we can ensure that they stand best to benefit from SOFA's long-term success, staying true to DeFi's commerical ideals of 'giving back' to true core users and early adopters.

The token buyback logic is an integral part of the SOFA protocol smart contract. Protocol administrators will regularly trigger this process to purchase and burn $RCH with protocol revenue through supported DEX venues. Destroyed $RCH will be no longer enter circulation, and the total amount of $RCH will gradually decrease over time on rising protocol usage.

More details of our Tokenomics model will be covered in its own dedicated section below.